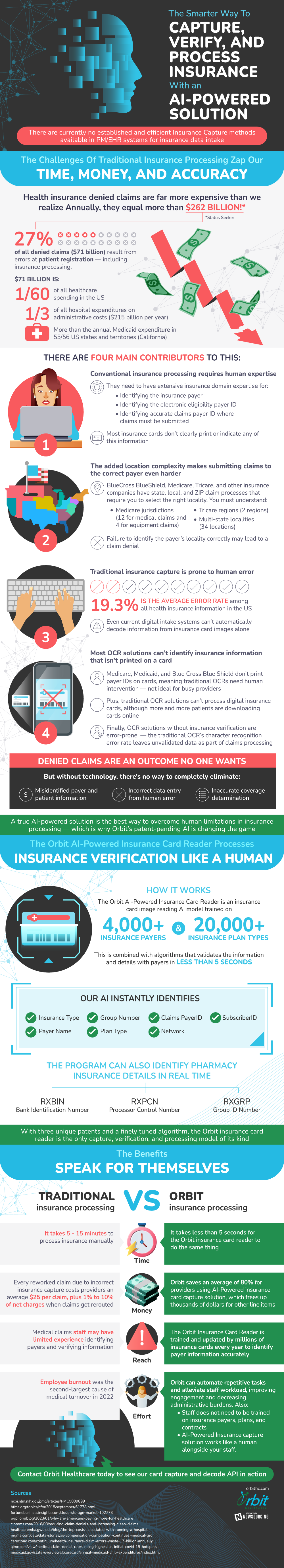

The process of capturing, verifying, and processing insurance is one that is outdated and in need of development. There are currently no established efficient methods to carry out this process, and experts are in search of a better way to drive this industry forwards. Denied claims cost billions annually, as the need for change becomes more and more pressing.

The main reasons for these problems lie in human error. Most current solutions to insurance identification cannot track any information not printed on a card. Because of this, highly trained individuals have to step in, performing the rest of the process manually. When humans are needed to intervene, the chance of error increases tremendously. In fact, the current error rate in all health insurance information in the United States is 19.3%. All of these factors create a perfect storm for inefficient processing and costly errors.

Luckily, there are new solutions in the works, specifically an AI-powered health insurance card capture alternative to current traditional methods. This card reading technology is trained on thousands of different plans and payers, and can instantly identify several different important metrics. What traditional methods can do in minutes, artificial intelligence can do in seconds, changing the game for insurance companies and plan holders forever.

Source: OrbitHC